12 Reasons Why You Need An Emergency Fund

Life can be unpredictable and sometimes you're hit with a sudden blow that is stressful AND costly. That's why it's good to have an emergency fund to cover any financial surprises that may come your way.

What is an emergency fund?

An emergency fund is money set aside in case of urgent or unplanned expenses. It provides a safety net so you don't have to stress about money or take on debt during a time of need.

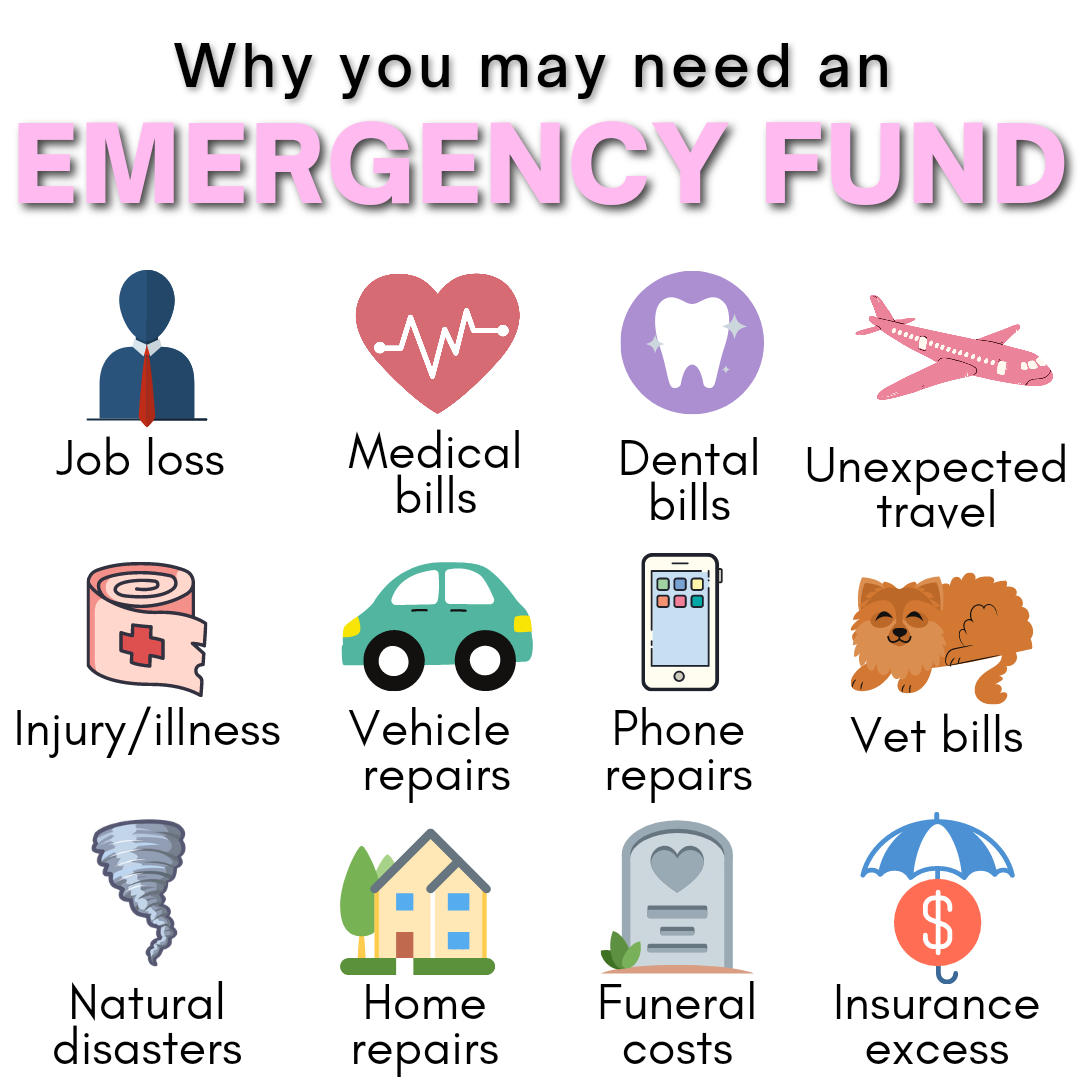

Here are just some of the reasons you may need an emergency fund.

Job loss

If the covid pandemic has taught us anything, it's that your employment status can change without warning. This is why it is ideal to have enough money saved in your emergency fund to cover three to six months of your expenses, so you can comfortably get by if you suddenly find yourself without an income.

Medical bills

It's no secret that medical bills can be incredibly expensive. Most people don't anticipate needing emergency medical care, but if you're hit with a sudden illness or injury, the last thing you want to be thinking about is your finances. Having enough money in your emergency fund for any medical bills that may come up will give you peace of mind and allow you to put your health first.

Dental bills

It doesn't matter how well you take care of your teeth, sometimes a toothache can just pop up out of nowhere. The only thing worse than going to the dentist is getting the bill at the end. You can't predict when you're going to need an urgent trip to the dentist and that's where your emergency fund comes in handy.

Unexpected travel

Normally travel is something fun that you plan and look forward to. However, there could be a time in your life where you need to travel unexpectedly due to unfortunate circumstances, such as a funeral or family emergency. An emergency fund can help you cover sudden travel costs, such as flights and accommodation, during a time of need.

Injury/illness

Nobody anticipates something bad happening to them, but unfortunately accidents are all too common. A sudden injury or illness could result in costly medical bills and/or a temporary loss of income. Having an emergency fund will give you one less thing to worry about, so you can focus on getting better.

Vehicle repairs

If you have ever owned a car, then you know there's a lot that can go wrong with them and they are NOT cheap to fix. Whether it's engine troubles or cosmetic repairs, cars can be expensive to own and definitely warrant having an emergency fund.

Phone repairs

We now rely on our phones more than ever, but gone are the days of the unbreakable Nokia brick phone. We've now replaced them with very fragile smartphones that are expensive to buy and expensive to repair. If you're as clumsy as I am, you will no doubt be dipping into your emergency fund for phone repairs.

Vet bills

If you have a pet then you know that your furry friend is just another member of the family. Sadly, the loveable goofballs are prone to injuries and illnesses that warrant visits to the vet. Can you put a price on love? Of course not, but you CAN have an emergency fund so you're ready to pay for those unexpected vet bills.

Natural disasters

Natural disasters are adverse events such as fires, floods, hurricanes and earthquakes. Although money will probably be the least of your problems, having an emergency fund can help you get by financially in the event of a natural disaster.

Home repairs

Whether you own or rent a home, you should have money aside for any unexpected repairs. These could include replacing broken appliances, fixing any damages or general wear and tear.

Funeral costs

The death of a loved one is not something anyone wants to think about, but during a time of grieving, the last thing you want to be worrying about is funeral costs. Funerals can cost anywhere between $4,000-$15,000, which is a significant amount of money to come up with suddenly, especially during a time of mourning.

Insurance excess

Insurance is great to have for peace of mind, however most insurance companies require you to pay an excess when you make a claim. Having enough money in your emergency fund to cover any excess will allow you to be fully prepared if you need to make an insurance claim.

Final thoughts

We may never know what is around the corner in life, but all to often it is something costly and stressful. Although it can be difficult to prepare for the unknown, it certainly pays to have an emergency fund that you can access when things go south. Having the peace of mind that you will be financially secure during a difficult time means you can focus on what's important instead of worrying about money.

Follow SavingLikeMad on social media to keep up to date with my side hustle journey, aswell as tips and motivation for saving money.

SavingLikeMad Instagram